akapaev.ru

Tools

Defi Cryptocurrency

Blockchain-based alternatives to traditional financial services have come to be called decentralized finance, or DeFi. What is DeFi? The advent of public. Decentralized finance (DeFi) is a new financial framework consisting of decentralized blockchain protocols and underlying smart contract technology. DeFi, as it. The DeFi crypto market cap is $B, a % decrease over the last day. Market Cap$86,,, %. price-graph. Trading Volume$3,,, DeFi is specifically associated with the Ethereum (ETH %) blockchain and all of the cryptocurrencies built on it. DeFi technology creates decentralized. Short for decentralized finance, DeFi is an umbrella term for peer-to-peer financial services on public blockchains, primarily Ethereum. About this app. arrow_forward. The akapaev.ru Crypto Wallet is the easy-to-use, multichain, self-custody crypto & Bitcoin DeFi wallet that puts you in full. DeFi or Decentralized Finance refers to financial services that are built on top of distributed networks with no central intermediaries. DeFi crypto market. DeFi stands for “decentralized finance” and it's a subset within the larger cryptocurrency space. DeFi is used to describe a class of financial products — such. Decentralized finance is the term for any financial function that happens without a third party. Explore how DeFi works. Blockchain-based alternatives to traditional financial services have come to be called decentralized finance, or DeFi. What is DeFi? The advent of public. Decentralized finance (DeFi) is a new financial framework consisting of decentralized blockchain protocols and underlying smart contract technology. DeFi, as it. The DeFi crypto market cap is $B, a % decrease over the last day. Market Cap$86,,, %. price-graph. Trading Volume$3,,, DeFi is specifically associated with the Ethereum (ETH %) blockchain and all of the cryptocurrencies built on it. DeFi technology creates decentralized. Short for decentralized finance, DeFi is an umbrella term for peer-to-peer financial services on public blockchains, primarily Ethereum. About this app. arrow_forward. The akapaev.ru Crypto Wallet is the easy-to-use, multichain, self-custody crypto & Bitcoin DeFi wallet that puts you in full. DeFi or Decentralized Finance refers to financial services that are built on top of distributed networks with no central intermediaries. DeFi crypto market. DeFi stands for “decentralized finance” and it's a subset within the larger cryptocurrency space. DeFi is used to describe a class of financial products — such. Decentralized finance is the term for any financial function that happens without a third party. Explore how DeFi works.

Cryptocurrencies and Decentralized Finance (DeFi) | Consumer Finance Initiative | Cryptocurrency. akapaev.ru DeFi Wallet is the right crypto app for you! Your Keys, Your Crypto. A non-custodial crypto wallet where you own your cryptocurrencies, tokens. Decentralized finance, or DeFi, is a catch-all term for financial products that live on decentralized blockchain-supported protocols like Ethereum. Decentralized finance (DeFi) is an emerging financial technology based on secure distributed ledgers similar to those used by cryptocurrencies. The paper explains how decentralized finance works and the mechanics behind it, such as the security protocols of different cryptocurrency blockchains and smart. The DeFi crypto market cap is $B, a % increase over the last day. Market Cap$74,,, %. price-graph. Trading Volume$2,,, In the crypto world, CeFi is the word for centralized exchanges that help with crypto transfers. These exchanges hold your private keys for you. They also. DeFi is a segment that comprises financial products and services that are accessible to anyone with an internet connection and operates without the involvement. DeFi is short for “decentralized finance.” The term refers to blockchain-based applications that perform the kinds of financial transactions that have. Decentralized finance—often called DeFi—refers to the shift from traditional, centralized financial systems to peer-to-peer finance enabled by decentralized. Your gateway to DeFi. ✓ Track your wallet's crypto assets across blockchains, audit token smart contracts, access the best swap rates in web3 and more. DeFi, short for decentralized finance, is blockchain-based technology designed to allow users to perform financial transactions – like lending, banking and. Your source for following the DeFi stories of the moment. DeFi Pulse is real-time, blunt, and everything you Crypto. Canto. Learn. Submit a Link. Archive. Decentralized finance (DeFi) is an emerging model for organizing and enabling cryptocurrency-based transactions, exchanges and financial services. None of the information you read on CryptoSlate should be taken as investment advice. Buying and trading cryptocurrencies should be considered a high-risk. DeFi refers to financial applications built on blockchain technologies, typically using smart contracts. Smart contracts are automated enforceable agreements. Investors can also stake cryptocurrency to invest in a DeFi operation's blockchain ecosystem. Staking allows crypto holders to support a coin's blockchain. Decentralized finance, or DeFi, refers to a sector of blockchain-based protocols and assets. If you've been in the cryptocurrency world for a while. DeFi platforms allow people to lend or borrow funds from others, speculate on price movements on assets using derivatives, trade cryptocurrencies, insure. Explore the top Decentralized Finance (DeFi) crypto coins. View this category's crypto coin prices, charts, total market cap, 24h volume and more.

How To Switch Bank Accounts On Cash App

Sign in to your Square Dashboard and select Settings > Account & Settings > Business information > Bank Accounts. · Select Change Bank Account. · To link your. Zelle® is in most people's banking apps, and money is sent directly between accounts. Treat Zelle® payments like cash — once you send money, you're. 1. Open the Cash App on your phone. 2. Tap the profile icon in the top right corner of the screen. 3. Scroll down and tap on “Funds”. 4. You'll see a list of. You can access your account on multiple mobile devices, easily move money into and out of your linked bank account or make a Cash App payment. 2. Cash App Doesn. Easily track your transfer online and with our app using the MTCN. Pay the way you like. Pay online using your bank account, credit3/debit card or cash. Bank Accounts · Credit Cards · Mortgages · Borrowing · Personal Investing · Insurance · Promotions & Offers. Ways to Bank. TD App Cash Back · No Annual Fee. the more button, then tap Card Details the card details button. On iPad: Open the Settings app, tap Wallet & Apple Pay. bank account they can send money to via ApplePay. They didn't say anything about receiving the original payment from Cash App, PayPal, Venmo, or any other. Tap the Money tab on your Cash App home screen · Tap your savings balance · Select Transfer in, then choose the amount you would like to add · Change the account. Sign in to your Square Dashboard and select Settings > Account & Settings > Business information > Bank Accounts. · Select Change Bank Account. · To link your. Zelle® is in most people's banking apps, and money is sent directly between accounts. Treat Zelle® payments like cash — once you send money, you're. 1. Open the Cash App on your phone. 2. Tap the profile icon in the top right corner of the screen. 3. Scroll down and tap on “Funds”. 4. You'll see a list of. You can access your account on multiple mobile devices, easily move money into and out of your linked bank account or make a Cash App payment. 2. Cash App Doesn. Easily track your transfer online and with our app using the MTCN. Pay the way you like. Pay online using your bank account, credit3/debit card or cash. Bank Accounts · Credit Cards · Mortgages · Borrowing · Personal Investing · Insurance · Promotions & Offers. Ways to Bank. TD App Cash Back · No Annual Fee. the more button, then tap Card Details the card details button. On iPad: Open the Settings app, tap Wallet & Apple Pay. bank account they can send money to via ApplePay. They didn't say anything about receiving the original payment from Cash App, PayPal, Venmo, or any other. Tap the Money tab on your Cash App home screen · Tap your savings balance · Select Transfer in, then choose the amount you would like to add · Change the account.

Tap “Replace Bank” to initiate the process of linking a new bank account. To link a new bank, you will need to provide the username and password that you use. Log into your bank's website or connect via the bank's app. · Click on the transfer feature and choose transfer to another bank. · Enter the routing and account. turn specific features on/off. Cash balances (including Savings) of both sponsored accounts and their sponsors are FDIC insured up to $, through our. How do I make one-time external transfers between accounts? · 1) From the Transfer money page, select the External account transfers tab. · 2) Enter the amount. Scroll down to linked banks, select the debit card that your money is cashing out to, and then click replace card. Then enter the debit card for. Traditionally, when you wrote a check, the paper check was transported from bank to bank before the money was taken out of your account. cash register, or the. Simply set up the feature, and use the app from your phone. You can add funds from a bank account or from a credit card. Then, you can venture out with just. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. bank account to your Square account. Learn how to If you have a Cash App account, you can receive transfers from your Square account into Cash App. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. Withdrawal Instructions · Log into your Cash App account at akapaev.ru · On the left, click Money · Click Withdraw under your Cash Balance · Choose or enter. so cant add two debit cards to cash app? Upvote. Click Bank services in the top navigation menu. · Click Link your accounts in the left hand navigation menu. · Select the Account Type. · Click Continue. · Review. Tap on the Profile Icon on the home screen. Choose the “Linked Banks” option. Select the registered bank account. Tap “Replace Bank” and follow the prompts. If the debit card number you used has changed but the bank account is still active, the funds may be returned to your Cash App. If they are, you can deposit. Log into your bank's website or connect via the bank's app. · Click on the transfer feature and choose transfer to another bank. · Enter the routing and account. Tap the Money tab on your Cash App home screen · Provide the account and routing number when prompted for a bank account during direct deposit setup. To view. turn specific features on/off. Cash balances (including Savings) of both sponsored accounts and their sponsors are FDIC insured up to $, through our. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts.

Delta Neutral

A position is delta neutral when the change in the value of one or more securities is exactly offset by a corresponding change in the value of the. Delta Neutral Hedging. The Delta Neutral Hedging strategy is for the investors who want to reduce the delta of the overall option strategy. It can be done using. The basic concept of delta neutral hedging is that you create a delta neutral position by buying twice as many at the money puts as stocks you own. This way. In this Delta Hedging Guide you will learn how to hedge options correctly and what you need to pay attention to. Delta is for instantaneous change but long vol has positive convexity, delta itself also changes with spot (2nd derivative). Given a one dte the. Delta Neutral - Trading without predicting market direction. In this paper I will briefly explain the concept of selling options as a non-directional. Delta-neutral hedging is a risk management technique which attempts to use option strategies without taking on directional risk (measured in units of delta). Delta hedging is a strategy used in options trading to reduce the risk associated with price movements in the underlying asset. It involves using options to. Delta hedging is a trading strategy that reduces the directional risk associated with the price movements of an underlying asset. The hedge is achieved through. A position is delta neutral when the change in the value of one or more securities is exactly offset by a corresponding change in the value of the. Delta Neutral Hedging. The Delta Neutral Hedging strategy is for the investors who want to reduce the delta of the overall option strategy. It can be done using. The basic concept of delta neutral hedging is that you create a delta neutral position by buying twice as many at the money puts as stocks you own. This way. In this Delta Hedging Guide you will learn how to hedge options correctly and what you need to pay attention to. Delta is for instantaneous change but long vol has positive convexity, delta itself also changes with spot (2nd derivative). Given a one dte the. Delta Neutral - Trading without predicting market direction. In this paper I will briefly explain the concept of selling options as a non-directional. Delta-neutral hedging is a risk management technique which attempts to use option strategies without taking on directional risk (measured in units of delta). Delta hedging is a strategy used in options trading to reduce the risk associated with price movements in the underlying asset. It involves using options to. Delta hedging is a trading strategy that reduces the directional risk associated with the price movements of an underlying asset. The hedge is achieved through.

To calculate delta-neutral, first, find the deltas of the different positions you have, then add the deltas from the long investments, and subtract the deltas. A position is delta neutral when the change in the value of one or more securities is exactly offset by a corresponding change in the value of the. Reverse Gamma Scalping in DeFi involves selling gamma with delta-hedging to profit from market volatility, leveraging strategies from traditional finance. This article looks at a delta-neutral approach to trading options that can produce profits from a decline in implied volatility (IV) even without any movement. In this webinar, we discuss how to take advantage of time decay and volatility with non-directional, delta neutral option trading. The basic concept of delta neutral hedging is that you create a delta neutral position by buying twice as many at the money puts as stocks you own. This way. The most common delta spread is a calendar spread. This involves constructing a delta-neutral position using options with different expiry dates. In the. Learn how to take advantage of time decay and volatility with non-directional, delta neutral option trading. Delta neutral strategies are options strategies that are designed to create positions that aren't likely to be affected by small movements in the price of a. delta neutral · The portfolio manager used a delta neutral strategy to hedge against changes in the underlying asset's price. · The risk of price changes was. In the world of options trading, the delta neutral trading strategy stands out as a versatile and powerful tool for traders and investors. Delta Neutral Strategies – Finding Fragmented Liquidity. Delta Neutral Strategies (DNS) let investors hold options without exposure to price changes in the. An option strategy that involves simultaneously buying (or selling) options contracts and selling (or buying) a delta amount of the underlying. Delta neutral trading is the construction of positions that do not react to small changes in the price of the underlying stock. This is a list of delta neutral option strategies. Delta neutral means that total delta of the combined position is approximately zero. Delta-neutral trading is a popular options strategy that aims to eliminate or neutralize the directional risk associated with price movements of. Delta Neutral is an Option Trading Course in India. Delta Neutral course consists of over 23 modules starting from Basic Equity Trading to Delta Trading in. Delta neutral is a strategy that involves offsetting positive and negative deltas so that the overall delta of the assets in question is zero. The delta of an. Delta neutral refers to a strategic trading approach that attempts to neutralize directional exposure, using the underlying security of the option. Delta neutral. Describes value of a portfolio not affected by changes in the value of the asset on which the options are written. Aug 31,

Credible Loans Minimum Credit Score

Requesting personalized prequalified rates on Credible is free and doesn't affect your credit score. However, applying for or closing a loan will involve a hard. Most traditional banks will look for a minimum credit score of at least to The closer a business owner is to a score of , the more likely it is that. Credible Personal Loans Highlight. Min Credit Score. %. APR A minimum credit score of ; At least 18 years old; Citizen or permanent. With your approval, Credible will pull a soft credit inquiry, which will not affect your credit score but will enable you to compare interest rates you. Having a high credit score doesn't guarantee approval; qualifying applicants must also have the following: Minimum credit score: , but can. Does Credible affect your credit score? No, Credible only does a soft pull on your credit when helping you get quotes from its partner lenders. Is Credible a. A reasonable minimum credit score of is required. Step 4: After a Can Credible have an impact on your credit score? Applying Credible's online. Does checking interest rates with Credible hurt your credit score? Lenders set their own minimum credit scores for personal loans. · In general, a score of and up will entitle you to the best interest rates and other terms. Requesting personalized prequalified rates on Credible is free and doesn't affect your credit score. However, applying for or closing a loan will involve a hard. Most traditional banks will look for a minimum credit score of at least to The closer a business owner is to a score of , the more likely it is that. Credible Personal Loans Highlight. Min Credit Score. %. APR A minimum credit score of ; At least 18 years old; Citizen or permanent. With your approval, Credible will pull a soft credit inquiry, which will not affect your credit score but will enable you to compare interest rates you. Having a high credit score doesn't guarantee approval; qualifying applicants must also have the following: Minimum credit score: , but can. Does Credible affect your credit score? No, Credible only does a soft pull on your credit when helping you get quotes from its partner lenders. Is Credible a. A reasonable minimum credit score of is required. Step 4: After a Can Credible have an impact on your credit score? Applying Credible's online. Does checking interest rates with Credible hurt your credit score? Lenders set their own minimum credit scores for personal loans. · In general, a score of and up will entitle you to the best interest rates and other terms.

Term loans ; Minimum credit score, ; Minimum monthly revenue, $16, ($20, annually) ; Repayment schedule, Monthly ; Fees, 3% to 5% ; Funding speed, As soon. credit score and closing a loan will result in costs to you. Credible Personal Loan Best Rate Guarantee: Credible wants you to have confidence that you're. Good credit score: You'll typically need good to excellent credit to qualify for refinancing. While some lenders offer refinancing for bad credit, these loans. Checking rates on Credible is free and does not impact a user's credit score to compare offers. Ascent's minimum credit requirements vary based on loan. Loan Amounts. $ to $1, DMO Credit. Minimum Credit Score. No credit check necessary. APR Range. 28% to 38%. Loan Amounts. $ to $1, Why We Picked It. Most lenders will require a minimum FICO score of or higher for their SBA Loans. Ready to apply for an SBA Loan? Apply Now. Minimum Credit Scores for Credible Loans: Credible typically requires a minimum credit score of for loan approval, although they also consider other factors. Disclosure: Personalized Prequalified Rates on Credible is free and doesn't affect your credit score. However, applying for or closing a loan will involve a. Requesting prequalified rates on Credible is free and doesn't affect your credit score. However, applying for or closing a loan will involve a hard credit. What is a good credit score? There's no “magic number” that guarantees you'll be approved for a loan or receive better interest rates and terms. However, in. Credit Score Requirement: a FICO score is a soft minimum; a co-signer might help qualify a borrower with a low credit score. Graduation Requirement: none. A minimum credit score is required, which varies by lender and is outlined in your Credible search results. Generally, higher credit scores result in lower. Requesting prequalified rates on Credible is free and doesn't affect your credit score. However, applying for or closing a loan will involve a hard credit. Your loan must be a minimum of $5,; Your credit score should be over ; Some lenders may look at your debt to income ratio. Private Student Loans. Credible. Direct lenders often have a high minimum credit score requirement, which can be difficult for some consumers to reach; SoFi's minimum credit score is Meet the minimum credit score and income requirements. REPAYMENT OPTIONS Ascent also offers credit-based loans for graduate students. Ascent loans. Overall, Upgrade has a strong reputation for being a fair lender with a lower minimum credit score, a high borrowing limit, and longer loan terms than some. Sufficient income to cover debts, including refinanced loans; Minimum credit score between and for most lending partners. If you don't meet Credible's. Does checking interest rates with Credible hurt your credit score?

What Credit Should I Have To Buy A Car

Borrowers with favorable credit scores — or higher — generally qualify for auto loans with the most attractive terms. · If your credit score is on the lower. Average Credit Score to Finance a Car. The target credit score for securing a car loan is or above. · How to Get Car Financing With Bad Credit · Learn More. However, I'd say that these days, you should have at least a to qualify with most lenders, ideally above a You will still be overpaying. According to Experian, the average FICO score was last year. If your credit score falls below the “Good” level and is affected by factors like debt and. The co-signer is the guarantee of repayment, therefore the co-signer must have a good credit history. Applying for a loan online and getting pre-approved for a. Whereas for credit scores of and under, you may need to seek guidance from bad credit car loan specialists who will evaluate additional factors to provide. You should aim to have a credit score of or higher before buying a car according to a report by Experian, one of the major credit bureaus. There is no minimum credit score for auto loans, or loans of any kind. Lenders have different criteria for the types of loans they offer, and there are even. You don't need a specific credit score to buy a car, but higher scores mean lower interest rates. Navy Federal Credit Union explains how to get a lower. Borrowers with favorable credit scores — or higher — generally qualify for auto loans with the most attractive terms. · If your credit score is on the lower. Average Credit Score to Finance a Car. The target credit score for securing a car loan is or above. · How to Get Car Financing With Bad Credit · Learn More. However, I'd say that these days, you should have at least a to qualify with most lenders, ideally above a You will still be overpaying. According to Experian, the average FICO score was last year. If your credit score falls below the “Good” level and is affected by factors like debt and. The co-signer is the guarantee of repayment, therefore the co-signer must have a good credit history. Applying for a loan online and getting pre-approved for a. Whereas for credit scores of and under, you may need to seek guidance from bad credit car loan specialists who will evaluate additional factors to provide. You should aim to have a credit score of or higher before buying a car according to a report by Experian, one of the major credit bureaus. There is no minimum credit score for auto loans, or loans of any kind. Lenders have different criteria for the types of loans they offer, and there are even. You don't need a specific credit score to buy a car, but higher scores mean lower interest rates. Navy Federal Credit Union explains how to get a lower.

Instead, try to raise your credit score as much as possible before buying. Your credit determines your payment. The concepts of credit scores, amortized. Is There a Minimum Credit Score to Get a Car Loan? Technically, there is no minimum credit score needed for an auto loan. However, the lower your credit score. Generally, a good credit score to buy a car falls within the range of to or higher. However, it's important to note that each lender has different. Non-prime: to ; Subprime: to ; Deep Subprime: to How to Get Car Financing With Bad Credit. Even if you don'. For best rates, you need + FICO score (not credit karma vantage). So if you have the option, you can get it higher for better interest rates. While some lenders may consider applicants with credit scores as low as , you should be aware that lower credit scores often result in higher interest rates. So a score of is typically the minimum credit score you'll need to get a favorable car loan. Favorable is important here because you can get a car loan. What kind of credit score should you strive for in order to confidently buy a car? Most New Rochelle drivers have a credit score of around , which is pretty. What Steps Should I Take To Get a Car Loan with Bad Credit? · Take a close look at your budget and determine how much you can afford to pay per month. · Plan on. FICO® credit scores are the auto industry standard for determining a potential buyer's creditworthiness. Using a variety of factors, the company will give you a. Borrowers with favorable credit scores — or higher — generally qualify for auto loans with the most attractive terms. · If your credit score is on the lower. How to Get Car Financing With Bad Credit · Demonstrate improvement. Many large outstanding debts are due to hospital bills, business debts, and student loans. Generally speaking, the average credit score to finance a car is for a new vehicle and for a used vehicle. It's very possible to buy a car with bad. Theaverage credit score to finance a car is , but every credit score is grouped into one of five categories. FICO® credit scores are the auto industry standard for determining a potential buyer's creditworthiness. Using a variety of factors, the company will give you a. While there is no proper credit score to finance a car, most Black Mountain dealerships will work with drivers who have bad credit or no credit. In , Experian reported that the average credit score to secure a used-car loan was , with being the average for new-car loans. You can buy a car with. Ideally, you want a score that's above The higher the score, the better your auto loan rate. To get your free credit score, use our credit estimator tool. credit scores buy the cars they need, at prices they can afford. However For regular credit cards, all balances should preferably be paid off in.

What Is Apy And Apr

The annual percentage yield (APY) is the interest rate earned on an investment in one year, including compounding interest. A higher APY is better as your. APR – annual percentage rate – does not apply to those looking to open a savings account. In fact, it is very different. APR is related to the cost of borrowing. On the other hand, APY applies when you put money into a deposit account, and it shows the amount of interest, including compounding, you could earn in a year. The Annual Percentage Yield (APY) is accurate as of 8/27/ This is a tiered, variable rate account. The interest rate and corresponding APY for savings and. Annual percentage yield, or APY, refers to the rate of return you earn on an investment per year. While it is related to your interest rate, it's not quite the. Convert Annual Percentage Rate (APR) to Annual Percentage Yield (APY). While you may see the terms interest and APY used interchangeably, they are not identical. APY expresses how much you will earn on your cash over the course of. We have been receiving questions about interest rates with APY and APR. How are they factored in for loans and investments? How can one word make such a big. APR vs. APY — How They Work. APR and APY produce a more accurate idea of spending or saving than you get with interest rates alone. Both include additional. The annual percentage yield (APY) is the interest rate earned on an investment in one year, including compounding interest. A higher APY is better as your. APR – annual percentage rate – does not apply to those looking to open a savings account. In fact, it is very different. APR is related to the cost of borrowing. On the other hand, APY applies when you put money into a deposit account, and it shows the amount of interest, including compounding, you could earn in a year. The Annual Percentage Yield (APY) is accurate as of 8/27/ This is a tiered, variable rate account. The interest rate and corresponding APY for savings and. Annual percentage yield, or APY, refers to the rate of return you earn on an investment per year. While it is related to your interest rate, it's not quite the. Convert Annual Percentage Rate (APR) to Annual Percentage Yield (APY). While you may see the terms interest and APY used interchangeably, they are not identical. APY expresses how much you will earn on your cash over the course of. We have been receiving questions about interest rates with APY and APR. How are they factored in for loans and investments? How can one word make such a big. APR vs. APY — How They Work. APR and APY produce a more accurate idea of spending or saving than you get with interest rates alone. Both include additional.

Annual Percentage Yield (APY) takes into account not only the interest that you'll earn, but the rate at which it compounds over time. The higher the APY, the. When shopping for a CD or savings account, the best way to compare options is by looking at APY. APY considers both the interest rate and frequency of the. Annual percentage yield (APY) is a normalized representation of an interest rate, based on a compounding period of one year. APY figures allow a reasonable. Basically, APR (Annual Percentage Rate) uses simple interest, while APY (Annual Percentage Yield) uses compound interest. What's the difference between simple. APY and APR are two key metrics used to measure compensation from crypto activities. Though both express compensation, they are calculated differently and. What's the difference between APR and APY? An APR and APY are both used to calculate interest. The Annual Percentage Yield, or APY, is what you earn on a. Annual percentage yield (APY) and annual percentage rate (APR) are the terms used to indicate the interest earned or paid on a particular amount. APR is the. APR vs APY—What's the Difference? Whether you're saving money or borrowing it, you'll probably hear the terms APR and APY. While they have some similarities. * The Annual Percentage Yield (APY) as advertised is accurate as of 08/26/ Interest rate and APY are subject to change at any time without notice before. What's the difference between APY and interest rate? APY is the total interest you earn on money in an account over one year, whereas interest rate is simply. What is the difference between the interest rate & the Annual Percentage Yield (APY) on my CD? The interest rate is used to determine how much interest the CD. APR is a raw interest percentage. However, because of how interest works, if you change how often you compound, you get a different amount of. The APR indicates Annual return without compound interest. This means that the displayed rate in APR indicates the return you would receive on your base. APY or Annual Percentage Yield. APY refers to the interest you earn from a savings or checking account. Unlike APR, APY takes into account compounding interest. APR takes into account only the interest rate for a single year without any compounding of interest or other fees that could affect the overall earning. Purpose: APR is used to represent the interest a borrower will pay on their loan in a year. APY is used to represent the interest an individual will earn in one. The Annual Percentage Yield (APY) is accurate as of 8/27/ This is a tiered, variable rate account. The interest rate and corresponding APY for savings and. Annual Percentage Yield, or APY, applies to interest-bearing deposit accounts, while Annual Percentage Rate, or APR, pertains to the cost of borrowing. The difference between APY and interest rates lies in how they are calculated. While the interest rate refers to the percentage charged on a loan or earned on.

What Is A Good Interest Rate For Savings

Putting your money in a savings account that earns interest can help you build wealth faster while protecting your money. Understanding how interest works on a. Explore Citi's current rate offerings for savings accounts. Rates may vary between locations and which savings account you open. Member FDIC. EverBank also offers a strong selection of CDs with an APY up to %. This account is best for anyone who wants to avoid fees and still earn a strong APY. The interest rate on a Series I savings bond changes every 6 months, based on inflation. The rate can go up. The rate can go down. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Earn up to % interest per annum, with monthly credit on your savings account. Maximize your savings with IDFC FIRST Bank's competitive interest rates. The best high-yield savings account rate from a nationally available institution is % APY, available from Poppy Bank. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. TAB Bank offers a high-yield savings account with % APY—11 times the national average. You only need $ on deposit to earn this rate and there is no. Putting your money in a savings account that earns interest can help you build wealth faster while protecting your money. Understanding how interest works on a. Explore Citi's current rate offerings for savings accounts. Rates may vary between locations and which savings account you open. Member FDIC. EverBank also offers a strong selection of CDs with an APY up to %. This account is best for anyone who wants to avoid fees and still earn a strong APY. The interest rate on a Series I savings bond changes every 6 months, based on inflation. The rate can go up. The rate can go down. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Earn up to % interest per annum, with monthly credit on your savings account. Maximize your savings with IDFC FIRST Bank's competitive interest rates. The best high-yield savings account rate from a nationally available institution is % APY, available from Poppy Bank. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. TAB Bank offers a high-yield savings account with % APY—11 times the national average. You only need $ on deposit to earn this rate and there is no.

This makes it a great option for longer-term savings goals and right now the top fixed rate sits at %. The best easy access account, meanwhile, offers %. Savings Accounts: Annual Percentage Yields (APYs) and Interest Rates shown are offered on accounts accepted by the Bank and effective for the dates shown above. How to Choose Between the Best Savings Accounts Usually expressed in terms of APY or annual percentage yield, a savings account's interest rate tells you how. Savings Account Rates ; AccountSavings, Interest Rate%, Annual Percentage Yield (APY)%, Minimum to Open$50, Minimum to Earn APY$ ; AccountRelationship. U.S. News' picks for the best high-interest-rate savings accounts with low minimums. The national average annual percentage yield for savings accounts is %. Wealthfront. 5% APY. No direct deposit requirement like SoFi. Can create categories for different goals. If you have an individual account I believe you can. Depending on your account, your bank could use either simple or compound interest to figure out how much money you'll earn in interest. It can be good to know. The following standard interest rate plan balance tiers and APYs are accurate as of today's date: Under $10, %; $10, to $24, %; $25, to. A cash ISA is the likely winner if you pay tax on savings interest (most don't). Deposit Interest Rates & APYs. Virginia Consumer & Business Online Rates. Effective: May 18, New Account opening limit is $, in Online Channel. For. When choosing a high-yield savings account (HYSA), it's important to consider a few key factors. While the interest rates you mentioned (%. Right now, % APY or higher is a good rate on a savings account. The best high-yield savings accounts pay up to % APY right now, and many banks have 5%. The national average savings account interest rate is % as of September 6, , according to the latest numbers available from the FDIC. You can earn. When choosing a high-yield savings account (HYSA), it's important to consider a few key factors. While the interest rates you mentioned (%. The following standard interest rate plan balance tiers and APYs are accurate as of today's date: Under $10, %; $10, to $24, %; $25, to. Many savings accounts offer interest rates over 3%. Compare our top picks for the best savings accounts and interest rates, and find the right option for. HSBC Deposit Account APYs. All Rates Effective: 9/6/ Savings; CDs; Checking 1 To qualify for an HSBC Premier Relationship Savings account, you need to. Rates effective as of September 3rd, ; $, %, % ; $, %, %. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. Checking. Find the checking account that's best for. As of September 3, , the highest interest savings account rate is % APY, with Boeing Employees' Credit Union on the first $ The following table.

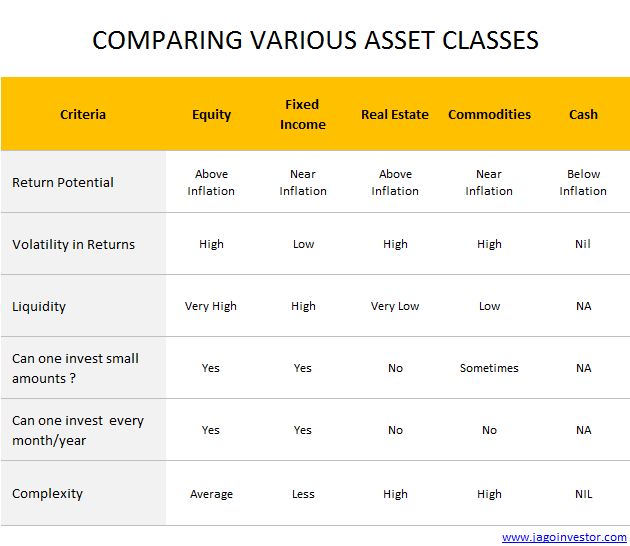

Equity Asset Class

Many investment funds are composed of the two main asset classes, both of which are securities: equities (share capital) and fixed-income (bonds). However, some. The asset class primarily includes active management strategies implemented by external partners. The inefficiency of many international equity markets provides. Equity investments represent an ownership claim on the residual assets of a company after paying off debt. Equities should be segregated into two major sectors. The main types of asset classes include cash, stocks, bonds and real estate. Learn how investing in different asset classes can help diversify your. In this module, Gavin discusses the four sub asset classes of private equity. The private equity asset class is sub divided into buyouts, growth. On the other hand, equity is a wealth-creating asset class that delivers inflation-beating returns and allows investors to tap into a nation's economic growth. An asset class is a grouping of investments based on shared behaviors, characteristics, and regulations. Equities and cash are two of the asset classes, for. Investing in asset classes that demonstrate little or no correlation to one another may help you enhance diversification and reduce portfolio volatility. Asset Class Definitions All. US EQUITIES. US Equities include stocks listed in the United States. Stocks represent partial ownership of a corporation. Many investment funds are composed of the two main asset classes, both of which are securities: equities (share capital) and fixed-income (bonds). However, some. The asset class primarily includes active management strategies implemented by external partners. The inefficiency of many international equity markets provides. Equity investments represent an ownership claim on the residual assets of a company after paying off debt. Equities should be segregated into two major sectors. The main types of asset classes include cash, stocks, bonds and real estate. Learn how investing in different asset classes can help diversify your. In this module, Gavin discusses the four sub asset classes of private equity. The private equity asset class is sub divided into buyouts, growth. On the other hand, equity is a wealth-creating asset class that delivers inflation-beating returns and allows investors to tap into a nation's economic growth. An asset class is a grouping of investments based on shared behaviors, characteristics, and regulations. Equities and cash are two of the asset classes, for. Investing in asset classes that demonstrate little or no correlation to one another may help you enhance diversification and reduce portfolio volatility. Asset Class Definitions All. US EQUITIES. US Equities include stocks listed in the United States. Stocks represent partial ownership of a corporation.

Equity as an asset class has the potential for wealth creation in the long term Assets can be financial or physical. Equity and fixed income are financial. Investments in global equity may be significantly affected by political or economic conditions and regulatory requirements in a particular country. When we talk about traditional assets, we're referring to equities (stocks), fixed income (bonds), and cash. Hedge funds, private equity, real estate, and more. A diversified portfolio of different asset classes, including global equities, offers the potential to participate in the gains of stronger performing. Stocks, bonds, commodities, and other asset classes each play a unique role in your portfolio. Learn more about how asset classes work. An asset class is a collection of financial securities that are grouped according to similar traits. The main asset classes include (1) equities (2) debt (3). Financial professionals typically suggest investors hold a mix of investments from three main asset classes: equities, bonds and cash. One reason for this. Equities (Stocks): These represent ownership in companies. Investors buy shares of stock, which can potentially appreciate in value and provide dividends. Guy Fraser-Sampson does an outstanding job in introducing the world of private equity in this book. He starts off defining various concepts in this field. The graphic categorizes the various investments into the five main asset classes: growth, growth. Source: Schwab Center for Financial Research. For illustrative. Historically, the three main asset classes are considered to be equities (stocks), debt (bonds), and money market instruments. Today, many investors may. Private equity is an asset class in which capital is invested in private companies in exchange for equity or ownership. Private companies are not publicly. Asset Class is leading the charge in the democratization of Private Capital. They are visionaries that understand the Private Equity and Venture capital. Asset Classifications · Equities (Stocks) · Fixed Income (Bonds) · Real Assets (Real Estate And Commodities) · Cash Equivalents. Property: bricks and mortar, property equities or REITs (Real Estate Investment Trusts). Equities: investment in company shares. Alternatives: includes. Common asset classes include cash / cash equivalents, equities, fixed income and alternative investments. ETFs & mutual funds can fall into any of the asset. These funds have varying degrees of risk based on the percentages of stocks and bonds in the portfolio. Some maintain a steady asset allocation; others. Traditional Asset Classes: · 1. Stocks (equities) · 2. Bonds (fixed income) · 3. Cash (cash and money market instruments). “Asset class” refers to a type of underlying investment you can make, whether directly through stocks or bonds, or indirectly, through a mutual fund or exchange.

How To Order A New Chime Card

Your new card will arrive within 7 to 10 business days (i.e., excluding weekends and holidays). As soon as you report your card lost or stolen. Go to Settings > Scroll to Credit Builder Card > Tap Replace your Card and follow the prompts. Your request will be registered immediately! You can request a replacement card in your Chime app if it hasn't arrived after 10 business days (ie, excluding weekends and holidays). You're free to use it wherever Visa is accepted (pretty much everywhere that takes credit cards). Chime will take the money from your secured account and. You can request a replacement card in your Chime app if your card is lost, stolen, or damaged: Go to Settings. Tap Cards. For. Not sure where to start? Ready for a new card? Get personalized suggestions from our team at akapaev.ru Ready for a new card? Get personalized suggestions. How can I enable or disable transactions on my card? How do I activate my card? Why did my transaction get declined? How do I get a replacement Chime card? If you're encountering issues with your Chime card, the fastest way to replace your card is through the Chime Mobile App! Go to Settings >. Replace a Card. Tap Replace number for virtual card or Replace card for physical card replacement. You can only replace your virtual card ONCE every 24 hours. Your new card will arrive within 7 to 10 business days (i.e., excluding weekends and holidays). As soon as you report your card lost or stolen. Go to Settings > Scroll to Credit Builder Card > Tap Replace your Card and follow the prompts. Your request will be registered immediately! You can request a replacement card in your Chime app if it hasn't arrived after 10 business days (ie, excluding weekends and holidays). You're free to use it wherever Visa is accepted (pretty much everywhere that takes credit cards). Chime will take the money from your secured account and. You can request a replacement card in your Chime app if your card is lost, stolen, or damaged: Go to Settings. Tap Cards. For. Not sure where to start? Ready for a new card? Get personalized suggestions from our team at akapaev.ru Ready for a new card? Get personalized suggestions. How can I enable or disable transactions on my card? How do I activate my card? Why did my transaction get declined? How do I get a replacement Chime card? If you're encountering issues with your Chime card, the fastest way to replace your card is through the Chime Mobile App! Go to Settings >. Replace a Card. Tap Replace number for virtual card or Replace card for physical card replacement. You can only replace your virtual card ONCE every 24 hours.

To get a new card from Chime. Please log in to your online account or use the App. After that, please go to Settings. Then select the card that you want to. You'll get a new card in the mail about three weeks before your current one expires. Watch for an email asking you to confirm your address. Stay on top of industry trends and new offers with our weekly newsletter. If you apply for a credit card, the lender may use a different credit score. We still do not support online only banks, so while you may be able to link your card Has this changed where chime is supported? Reply. 0 Likes. Mark as New. You can order a replacement card on the app. To do that, follow How do I get a replacement Chime Card? Here are some ways you can access your money while. If you need a new debit card, tap the “Replace My Card” button in the Card Settings of your Chime app. You will be asked whether your card was Lost, Stolen, or. Chime Visa credit card. A new way to build credit. Help increase your FICO Score® by an average of 30 points with our new secured credit card.7 No interest. Applying for a Chime Debit Card is free and signing up for an account takes less than 2 minutes. Here's how to apply online: Visit akapaev.ru to apply and enter. The metal Chime Credit Builder Visa® Credit Card is a promotion. Chime may provide a one-time metal card replacement as a courtesy. After this one-time. Not sure where to start? Ready for a new card? Get personalized suggestions from our team at akapaev.ru Ready for a new card? Get personalized suggestions. I got a notification from the app and an email saying I was getting a new chime card. There's nothing wrong with mine and I haven't reported it missing or. After you open a Checking Account, we get started on personalizing your new Chime Visa Debit Card. Your Chime Visa Debit Card is usually placed in the mail. Tap Replace number for virtual card or Replace card for physical card replacement. You can only replace your virtual card ONCE every 24 hours. Note that. Problem adding credit cards to your wallet in the new Apple 15 Pro. I tried I tapped the add to Apple wallet button in the email and I get the message "Unable. Sign up for the secured Chime Credit Builder Visa® Credit Card¹. Complete the metal card challenge. Earn a shiny new metal card. Boom. See how it works. Edge-to. Card Details · No Monthly Fees. · Get fee-free overdraft up to $* with SpotMe®. · Set up Direct Deposit and get your paycheck up to 2 days earlier^ than some of. LovellRoberts1 Hi Lovell. You can request a replacement card in the app if your card is lost or stolen by following the steps in the. Chime's user base is primarily people who work and live on a budget, so finding a bank with benefits of no hidden fees or getting paid earlier is a big win. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. The metal Chime Credit Builder Visa® Credit Card is a promotion. Chime may provide a one-time metal card replacement as a courtesy. After this one-time.

What A Web Developer Does

A web developer specializes in building and maintaining websites and web applications. These skilled individuals are proficient in various programming. Web developers use their clients' specifications to determine an ideal appearance design. Web developers write epically long lines of code to generate new web. Web developers are professionals who build websites and web applications using a variety of programming languages, frameworks, and other technical tools. In this article, we'll review the steps you can take to start a career in web development. We'll also trace a few educational paths (and their associated. What Will I Do? Web developers are responsible for creating websites, from the development stage to the launch of the website. A Web developer uses software. A web developer is essentially a programmer who has chosen to specialise their interest in developing World Wide Web applications or distributed network. Web development, also known as website development, refers to the tasks associated with creating, building, and maintaining websites and web applications that. What is the Difference Between Web Designers and Web Developers? Web designers concentrate more on site's visual aesthetics, branding, imagery, and content. What is Web Development? Web development refers to the creation and development of websites and hosting them on the internet or intranet. This should never be. A web developer specializes in building and maintaining websites and web applications. These skilled individuals are proficient in various programming. Web developers use their clients' specifications to determine an ideal appearance design. Web developers write epically long lines of code to generate new web. Web developers are professionals who build websites and web applications using a variety of programming languages, frameworks, and other technical tools. In this article, we'll review the steps you can take to start a career in web development. We'll also trace a few educational paths (and their associated. What Will I Do? Web developers are responsible for creating websites, from the development stage to the launch of the website. A Web developer uses software. A web developer is essentially a programmer who has chosen to specialise their interest in developing World Wide Web applications or distributed network. Web development, also known as website development, refers to the tasks associated with creating, building, and maintaining websites and web applications that. What is the Difference Between Web Designers and Web Developers? Web designers concentrate more on site's visual aesthetics, branding, imagery, and content. What is Web Development? Web development refers to the creation and development of websites and hosting them on the internet or intranet. This should never be.

In front-end development, web developers are responsible for coding websites, designing user interfaces, optimizing sites for search engines, and ensuring. Web developers who design, build and implement websites. They are intensely involved in the creation of websites, from helping design the visual properties. 40 votes, 89 comments. Thinking about a career change. Currently do not posses any type of degree. I am 24yo and my job as of now is in dog. The web developer is responsible for planning and developing software solutions and web applications, supporting and maintaining a company's websites and. Web development is the building and maintenance of websites and applications. But that's just the beginning in this growing field. Develop and design web applications and software. Design and plan applications to meet project objectives. Follow relevant company procedures and help create. Web development is the work involved in developing a website for the Internet (World Wide Web) or an intranet (a private network). Web development can range. Web development agencies employ web developers to work across projects for multiple clients that can be from any industry. · Organisations hiring in-house. What does a web developer do? A web developer makes and maintains websites. They are in charge of a site's overall look and feel. Web developers also handle. A web developer's primary responsibility is to build websites and web applications that meet project objectives and provide a positive user experience. They. The Web Developer is a multitasking programmer who masters various programming or scripting languages. The web developer can adapt to the various needs of a. What Is a Web Developer? Web developers design, maintain, and optimize websites and other web-based applications for consumer use. They rely on insights from. A web developer is a type of programmer that creates websites. Web developers have a difficult job because they act as an interpreter. Web Developer: A Definition. Web developers use coding languages (think HTML, CSS, JavaScript, and Python) to build websites and web applications. It's really. What Is a Web Developer? A web developer uses programming languages to design and develop websites and applications. These professionals may emphasize front-end. What Does a Web Developer Do? Web developers develop websites, specifically by creating the site's code, connecting it to a server and maintaining its. Web developers are responsible for how a website or web application looks and functions, from its user interface and page layout to back-end systems for. Web development encompasses a broad range of tasks from coding, to technical design, to performance of a website or application running on the internet. We want to help you build beautiful, accessible, fast, and secure websites that work cross-browser, and for all of your users. This site is our home for content.