akapaev.ru

Tools

S&P 500 For The Week

Recent S&P 52 Week Lows. This page shows all US equities that have recently made a new 52 week low. Join Our Market Watch Newsletter! S&P Index ; Open. 5, Previous Close5, ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range4, - 5, Even with this week's 4% pullback in the S&P , the forward P/E is still at a historically high level of 20 and that multiple is not priced for a rough. Find the latest S&P (^GSPC) stock quote, history, news and other vital information to help you with your stock trading and investing. New Lows ; YTD, 4 times, +% ; Week, 15 times, +% ; 2-Year, 13 times, +% ; 3-Year, 11 times, +%. There have been just 29 instances (29/ weeks = % of the weeks) when the S&P dropped 5% or more in a calendar week. New Lows ; YTD, 4 times, +% ; Week, 17 times, +% ; 2-Year, 15 times, +% ; 3-Year, 12 times, +%. Browse our Weekly Market Recap for a summary of the latest U.S. stock market headlines and insights, including an update on the S&P returns. Palantir, Dell Among New S&P Members as Index Rebalances. updated Sep 6, Personal-finance. Stocks Hit by Jobs in Worst Week Since March Markets. Recent S&P 52 Week Lows. This page shows all US equities that have recently made a new 52 week low. Join Our Market Watch Newsletter! S&P Index ; Open. 5, Previous Close5, ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range4, - 5, Even with this week's 4% pullback in the S&P , the forward P/E is still at a historically high level of 20 and that multiple is not priced for a rough. Find the latest S&P (^GSPC) stock quote, history, news and other vital information to help you with your stock trading and investing. New Lows ; YTD, 4 times, +% ; Week, 15 times, +% ; 2-Year, 13 times, +% ; 3-Year, 11 times, +%. There have been just 29 instances (29/ weeks = % of the weeks) when the S&P dropped 5% or more in a calendar week. New Lows ; YTD, 4 times, +% ; Week, 17 times, +% ; 2-Year, 15 times, +% ; 3-Year, 12 times, +%. Browse our Weekly Market Recap for a summary of the latest U.S. stock market headlines and insights, including an update on the S&P returns. Palantir, Dell Among New S&P Members as Index Rebalances. updated Sep 6, Personal-finance. Stocks Hit by Jobs in Worst Week Since March Markets.

Investing $50 a week into the S&P (*based on historical averages from ). Discussion. Capitalize on the around-the-clock liquidity of E-mini S&P futures (ES), and take advantage of one of the most efficient and cost-effective ways to gain. Realtime Prices for S&P Stocks ; Assurant, ; AT&T, ; Atmos Energy, ; Autodesk, The S&P Index has gained % annualized since , while the cumulative gain of all Tuesday trading sessions was %. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80%. Markets. Stocks Stage Impressive Comeback After Data-Driven Selloff · Markets. S&P , Nasdaq Find Footing For Strong Finish · Stocks. Stock Market News Today, 9. Open5, · Day High5, · Day Low5, · Prev Close5, · 52 Week High5, · 52 Week High Date07/16/24 · 52 Week Low4, · 52 Week Low Date10/ How to trade the S&P · How to trade the DAX · How to trade the FTSE · Commodities · What are commodities and how do you trade them? Oil trading · Gold. Invest in the S&P and hold. It will always come back up, because history. Is this idea still valid today and in the next decade? I was DCA'ing weekly into an S&P ETF and have gotten a healthy return, but I can't see how it can will keep climbing, so I've halted. The current value of S&P Index is 5, USD — it has risen by % in the past 24 hours. Track the index more closely on the S&P Index chart. S&P Index Options · A.M. Settlement (SPX) · Weeklys (SPXW) · End-of-Month · Mini (XSP) · LEAPS · FLEX. week's selloff. In extended trading, Oracle surged 9% after reporting S&P and Nasdaq Composite both gained %. All 11 S&P sectors advanced. S&P Index ($SPX) ; 5-Day, 5,, , %, 0 ; Day, 5,, +, +%, 0. S&P Returns (%). YTD 1 week. Latest News · Markets. Nasdaq Extends Selloff, Turns in Worst Week Since · Stocks. Stock Market News Today, 9/6/24 – Indices Fall after Key Jobs Data Misses. S&P Index ; Day Range 5, - 5, ; 52 Week Range 4, - 5, ; 5 Day. % ; 1 Month. % ; 3 Month. %. Nasdaq , S&P see strong recovery rallies but FTSE stays range bound as probability of 50 bps Fed rate cut increases. News ; S&P Starts September With % Weekly Loss Amid Worries Over Jobs Data, AI Demand · 09/06 ; US Equity Indexes Sink With Treasury Yields as Nonfarm. Tuesday alone has a better stock market performance than all five trading days combined! Tuesdays rose an annualized %, compared to % for the S&P

Racoon In Attic Removal Cost

Reasonable Cost ($$). This is for the cost for removal for more serious wild animal control professionals in Louisville. At this price, you can. The Cost of Raccoon Removal Services in Greensboro · Most Affordable Cost ($ ). This is normally the lowest end guys you will certainly get doing removal. These costs can vary to as little as $ total, to much higher in some cases over $, depending on the company and the number of service trips and number. On average, the cost can range from $ to $1, It is important to hire a professional to handle raccoon removal to ensure the safety of both the homeowner. Typically raccoon removal costs vary between $ and $ The base fees cover the installation of the one way door to allow animals to exit. Trapping per raccoon costs around $ Removing a dead raccoon costs around $, while getting rid nest of kits (baby raccoons) costs around $ Removal of the raccoons and covering the holes they used to get in costs around $ to $ generally, yet might cost even more if significant damage has. I don't know what a professional service would cost, but you could try driving them out yourself. My BIL managed to get some very stubborn raccoons to vacate a. Probably no less than $, maybe an average of $$, and maybe up to $ or more if you need widespread home repairs and attic cleanup services. Reasonable Cost ($$). This is for the cost for removal for more serious wild animal control professionals in Louisville. At this price, you can. The Cost of Raccoon Removal Services in Greensboro · Most Affordable Cost ($ ). This is normally the lowest end guys you will certainly get doing removal. These costs can vary to as little as $ total, to much higher in some cases over $, depending on the company and the number of service trips and number. On average, the cost can range from $ to $1, It is important to hire a professional to handle raccoon removal to ensure the safety of both the homeowner. Typically raccoon removal costs vary between $ and $ The base fees cover the installation of the one way door to allow animals to exit. Trapping per raccoon costs around $ Removing a dead raccoon costs around $, while getting rid nest of kits (baby raccoons) costs around $ Removal of the raccoons and covering the holes they used to get in costs around $ to $ generally, yet might cost even more if significant damage has. I don't know what a professional service would cost, but you could try driving them out yourself. My BIL managed to get some very stubborn raccoons to vacate a. Probably no less than $, maybe an average of $$, and maybe up to $ or more if you need widespread home repairs and attic cleanup services.

Reasonable Cost ($$). This is for the cost for removal for more serious wild animal control professionals in Pittsburgh. At this cost, you can expect. How much does it cost to have raccoons removed from your attic? Well, the raccoon removal costs vary depending on the size of the job and the company you. If your attic was inhabited by raccoons, you may need an attic cleanup. There is no way to tell you how much the repairs, or attic cleanup service will cost. We got a quote from terminex for to include two years of any wildlife removal in our house and yard plus sealing and sanitizing of the attic. Simply trapping a raccoon should not cost more than $$, but the cost to remove a raccoon family & sealing all entry points can be more. These costs can vary to as little as $ total, to much higher in some cases over $, depending on the company and the number of service trips and number. Raccoon trapping services should not cost more than $ $ That is typically not how a raccoon removal project goes because there is generally more than. The cost to remove raccoons will run around $80 per trap, $77 for the inspection, and between $$ for removing dead raccoons and their nests. Roof top raccoon trapping and one way doors are the most reliable ways to get the attic raccoon out. In this type of situation, the trap or one way door device. Raccoons in Attic Cost $$ For example, if you have raccoons in the attic, we might charge as such: $$ service & trap setup fee + $$75 per. You should call your local wildlife rehab or wildlife control center immediately. They will take care of it without cost to you. Live trapping and relocation is the standard recommendation for $ to $ for attic removals. When babies are present, manual removal could be used with live. If things go well, it might cost about $ Sometimes other species like opossums or skunks show up in traps. If we have to come out to remove another animal. Cost for removal such as trapping or harassment can vary depending on the situation but on average ranges from $ to $ Repairs such as sealing out areas. Raccoons are more expensive to deal with because we faces greater risks when removing them. This is as compared to having to deal with other wild. The per-animal removal cost, varying from $60 to $ per trapped raccoon, depended on factors such as trap placement and property location, with additional. You'll also see budget options in California enter this range when they need to trap in your attic. Higher price scenarios ($+). This situation usually. The price for professional trapping and removal of raccoons varies widely. In a yard, raccoon removal may be $$ A nest in an attic with babies may be. Raccoon Removal Costs ; Live trap, $$ per trap/raccoon ; Initial inspection, $$ per inspection ; Removal of dead raccoons, $$ per animal. Removing a dead raccoon costs around $, while getting rid nest of kits (baby raccoons) costs around $ However, the best option for permanent animal.

How Are Donations Deducted From Taxes

Taxpayers can deduct charitable contributions by itemizing their deductions using Schedule A (Form ). For non-cash contributions greater than $, the IRS. donations as a personal charitable deduction on Schedule. A (Form ). This provides a tax benefit only if you are able to itemize your deductions. The IRS. Federal law limits your state and local tax (SALT) deduction to $10, if single or married filing jointly, and $5, if married filing separately. Many charities actively solicit the donation of used cars and other vehicles. To claim a deduction of $ or more for a vehicle you donate, you of course. Donation bunching is a tax strategy that consolidates your donations for two years into a single year to maximize your itemized deduction for the year you make. Know the types of donations you can deduct. Beyond monetary donations via cash, credit, and checks, you can also claim tax deductions on donated goods and. Your monetary donations and donations of clothing and household goods that are in “good” condition or better are entitled to a tax deduction, according to. The donation cannot exceed 60% of your Adjusted Gross Income (AGI) in order to qualify as a tax deduction. For example, if you made $,, then you can. The IRS allows deductions for cash and noncash donations based on annual rules and guidelines. Article Sources. Taxpayers can deduct charitable contributions by itemizing their deductions using Schedule A (Form ). For non-cash contributions greater than $, the IRS. donations as a personal charitable deduction on Schedule. A (Form ). This provides a tax benefit only if you are able to itemize your deductions. The IRS. Federal law limits your state and local tax (SALT) deduction to $10, if single or married filing jointly, and $5, if married filing separately. Many charities actively solicit the donation of used cars and other vehicles. To claim a deduction of $ or more for a vehicle you donate, you of course. Donation bunching is a tax strategy that consolidates your donations for two years into a single year to maximize your itemized deduction for the year you make. Know the types of donations you can deduct. Beyond monetary donations via cash, credit, and checks, you can also claim tax deductions on donated goods and. Your monetary donations and donations of clothing and household goods that are in “good” condition or better are entitled to a tax deduction, according to. The donation cannot exceed 60% of your Adjusted Gross Income (AGI) in order to qualify as a tax deduction. For example, if you made $,, then you can. The IRS allows deductions for cash and noncash donations based on annual rules and guidelines. Article Sources.

Expenses that build up because of volunteering activities are also deductible. Important: The rules for deducting charitable contributions have changed for tax. You can usually deduct the full fair market value of appreciated long-term assets that you've held for more than one year and a day—such as stocks, bonds. Yes, you can potentially take a charitable tax deduction if you donated land or real estate to a charity or organization. You can do this by deducting the fair. You can generally only deduct contributions you've made to charity if you itemize your deductions. · If you do plan to deduct your donations, make sure you have. Your monetary donations and donations of clothing and household goods that are in “good” condition or better are entitled to a tax deduction, according to. Those who are charitably inclined and find themselves on the margin between taking the standard deduction or itemizing could maximize their tax benefits by “. Generally, a donor may deduct an in-kind (or, non-cash) donation as a charitable contribution. And a donor must obtain a written acknowledgment from the charity. A tax-deductible donation is a charitable contribution of money or goods to a qualified, tax-exempt organization, which may reduce the amount of federal income. If you itemize your deductions, you may be able to deduct charitable contributions of money or property made to qualified organizations. Only donations actually. 1. How much of my donation is tax deductible? When you donate to an IRS-recognized charity, you can typically deduct the donation on your tax return. The. To claim charitable donations, you'll need to itemize your deductions on your tax return instead of taking the standard deduction. List your total itemized. You can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50% depending on the type of. For tax years beginning in , an individual who does not itemize deductions may claim a deduction in calculating taxable income (and not as an above-the-line. What kinds of charitable contributions are deductible? · If property is donated, your deduction is generally equal to the property's fair market value. · If you. All cash, or cash equivalent, donations can only be deducted if you keep certain records. Record requirements for cash charitable donations depend on the value. The IRS only permits deductions for donations of clothing and household items that are in "good condition or better." If you bring $1, in clothes or. 1. How much of my donation is tax deductible? When you donate to an IRS-recognized charity, you can typically deduct the donation on your tax return. The. According to the Internal Revenue Service (IRS), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so. Donations are immediately deductible, and you can distribute from the account at your own pace. We suggest you consult your tax advisor on ways to maximize the. Corporations may not deduct more than 10 percent of their pretax income in a given year but, like individuals, may carry forward excess donations for five years.

Using 401k For Home Down Payment

absolutely not! Your K has rules and regulations as well as interest and penalties. It's for retirement not a savings for your mortgage down. You can use your (k) funds to buy a home. By withdrawing funds or by taking a loan from the account. Withdrawing funds from your (k) are limited to your. Pros and Cons of k loan for down payment · k loan has max of $50k or 50%, whichever is lower · k loan may need to paid back immediately. Keep in mind that you will need to withdraw enough money to cover the 10% penalty and the income taxes. So, if you need $10, for your down payment, you will. 4. Impact on Retirement Savings: Using funds from your (k) for a home down payment can significantly impact your retirement savings. Not. Accessing your (k) gives you immediate, assured and liquid funding for your down payment, putting you on the path to paying off your home loan sooner. Your (k) can be used toward a down payment on a home, but that doesn't mean it's the best solution. Know what could happen before touching retirement. Hardship withdrawals do not cover mortgage payments, but using a (k) for a down payment for a first-time home buyer could be allowed. The IRS has very. Key Takeaways. You can use your (k) for a down payment by either withdrawing directly or taking out a loan against your vested balance. When choosing between. absolutely not! Your K has rules and regulations as well as interest and penalties. It's for retirement not a savings for your mortgage down. You can use your (k) funds to buy a home. By withdrawing funds or by taking a loan from the account. Withdrawing funds from your (k) are limited to your. Pros and Cons of k loan for down payment · k loan has max of $50k or 50%, whichever is lower · k loan may need to paid back immediately. Keep in mind that you will need to withdraw enough money to cover the 10% penalty and the income taxes. So, if you need $10, for your down payment, you will. 4. Impact on Retirement Savings: Using funds from your (k) for a home down payment can significantly impact your retirement savings. Not. Accessing your (k) gives you immediate, assured and liquid funding for your down payment, putting you on the path to paying off your home loan sooner. Your (k) can be used toward a down payment on a home, but that doesn't mean it's the best solution. Know what could happen before touching retirement. Hardship withdrawals do not cover mortgage payments, but using a (k) for a down payment for a first-time home buyer could be allowed. The IRS has very. Key Takeaways. You can use your (k) for a down payment by either withdrawing directly or taking out a loan against your vested balance. When choosing between.

Using a k loan to finance your down payment can put you in a more favorable position for financing your mortgage. And, these loans are not reported to the. Owning a home can be a huge milestone for most people but raising funds for the down payment can be difficult. Hence, people consider using their (k). Larger down payment: Using your retirement savings can boost your down payment, enabling you to secure a more favorable mortgage rate and potentially avoid the. Bottom line, using those retirement funds to purchase a home can be a great option. And after the down payment and closing costs comes your monthly mortgage. The funds in your (k) retirement plan can be tapped for a down payment for a home. You can either withdraw or borrow money from your (k). More In Retirement Plans Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan. Some people may choose to tap their retirement balances for down payment money through a (k) loan or early withdrawal. This isn't a decision to consider. FHA: You are allowed to use a K loan. You do not have to factor the payment in to your debt ratio. USDA: You are allowed to use a K loan. You do not have. Although there are drawbacks, sometimes a (k) loan or withdrawal is the best way to come up with the down payment for a home. Before deciding to dip into. If you're still thinking about using your (k)-retirement savings for a home down payment, we really encourage you to consider all your options and work with. You can use the money you've invested in a retirement account, such as a (k) or IRA, to help purchase a home. The IRS is able to limit how much money you can borrow for a house downpayment. · Depending on your (k) plan, you could have up to 25 years to pay back the. The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to. You should be able to use money from your k to cover the cost of your down payment when buying a home. You could also use these funds to pay closing costs. Are you a first-time homebuyer looking for ways to afford a down payment? Or are you a seasoned homeowner looking to upgrade your living situation? Hardship withdrawals do not cover mortgage payments, but using a (k) for a down payment for a first-time home buyer could be allowed. The IRS has very strict. Accessing your (k) gives you immediate, assured and liquid funding for your down payment, putting you on the path to paying off your home loan sooner. If you're still thinking about using your (k)-retirement savings for a home down payment, consider all your options and work with a financial professional. Should You Tap Into Your (k) To Buy A Second House? · Yes, you can, in a nutshell. · Using (k) funds to purchase a home: · Making a down payment with your. Keep in mind that you will need to withdraw enough money to cover the 10% penalty and the income taxes. So, if you need $10, for your down payment, you will.

Transferring Ira To Roth Ira

When you make a transfer from a rollover IRA to a Roth IRA this is called a Roth conversion. A Roth conversion occurs when an account owner. If you choose to have the funds distributed directly to you and want to put them into your Roth IRA as a conversion, you must deposit them into the Roth IRA. A Roth conversion refers to taking all or part of the balance of an existing traditional IRA and moving it into a Roth IRA. A Roth conversion occurs when you move funds from a traditional individual retirement account (IRA) to a Roth IRA. Converting a traditional IRA to a Roth IRA isn't an all-or-nothing deal at a single moment in time. You can convert as much or as little of the money from your. Transfer the assets by completing a mutual fund IRA Transfer Form or Brokerage IRA Transfer Form. Complete this IRA Roth Conversion Form. A conversion to a Roth IRA results in taxation of any untaxed amounts from the traditional IRA. The conversion will be reported on Form , Nondeductible. Then locate the traditional IRA you want to convert and click Convert to Roth IRA. IS A ROTH IRA CONVERSION RIGHT FOR YOU? Understand the benefits of a Roth. A Roth IRA conversion allows you, regardless of income level, to convert all or part of your existing traditional IRA funds to a Roth IRA. When you make a transfer from a rollover IRA to a Roth IRA this is called a Roth conversion. A Roth conversion occurs when an account owner. If you choose to have the funds distributed directly to you and want to put them into your Roth IRA as a conversion, you must deposit them into the Roth IRA. A Roth conversion refers to taking all or part of the balance of an existing traditional IRA and moving it into a Roth IRA. A Roth conversion occurs when you move funds from a traditional individual retirement account (IRA) to a Roth IRA. Converting a traditional IRA to a Roth IRA isn't an all-or-nothing deal at a single moment in time. You can convert as much or as little of the money from your. Transfer the assets by completing a mutual fund IRA Transfer Form or Brokerage IRA Transfer Form. Complete this IRA Roth Conversion Form. A conversion to a Roth IRA results in taxation of any untaxed amounts from the traditional IRA. The conversion will be reported on Form , Nondeductible. Then locate the traditional IRA you want to convert and click Convert to Roth IRA. IS A ROTH IRA CONVERSION RIGHT FOR YOU? Understand the benefits of a Roth. A Roth IRA conversion allows you, regardless of income level, to convert all or part of your existing traditional IRA funds to a Roth IRA.

There's no age limit or income requirement to be able to convert a traditional IRA to a Roth. You must pay taxes on the amount converted. The distribution from the IRA would have to be done by December 31 of the tax year. Then, if the distribution is completed on December 31, the transfer to the. You will owe taxes on the amount of pre-tax assets (includes earnings of after-tax contributions) you convert to a Roth IRA. 4. Roth IRA accounts may not be. How do you transfer funds to a Roth IRA? You can convert the funds by having your plan administrator facilitate the funds transfer, or by allowing the. Get step by step guidance on how to convert your existing retirement account to a Roth IRA. See if a Roth Conversion makes sense for you. Use this form to convert all or a portion of an existing “traditional” Merrill Individual Retirement Account (IRA), Rollover IRA (IRRA®), SEP or SIMPLE. A rollover allows you to take a distribution from your traditional IRA—usually by check or online transfer—and move that money into your Roth within the next Generally, you'll only be able to transfer a (k) to a Roth IRA if you are rolling over your (k), the plan allows in-service withdrawals, or the plan. A Roth conversion involves moving assets from a qualifying retirement plan into a Roth IRA. There are a couple of ways to do this: Direct Rollover: Transfer. Then as your Roth IRA builds back up, it will grow tax free, and you won't owe any taxes on distributions," said Damaryan. Deciding on the Right Move. In. Start at your balances and holdings (logon required) Then locate the traditional IRA you want to convert and click Convert to Roth IRA. A Roth conversion is the process of repositioning your assets in a Traditional IRA or an eligible distribution from your qualified employer sponsored. Same trustee transfer: When your IRAs are held at the same financial institution, you can tell the trustee to transfer an amount from your traditional IRA to. Pre-tax assets that are converted from a traditional IRA or other eligible retirement plan to a Roth IRA are treated as a taxable distribution and are subject. Rollovers must also be completed within 60 days of the distribution from the Traditional IRA. The five-year period for which Roth IRAs must be held before. Related Content. Withdraw from IRA · How to open a Rollover IRA · How to fund an IRA. All tax-deferred IRAs, including traditional, rollover, SIMPLE,2. SEP, and SAR-SEP IRAs, are eligible for a Roth IRA conversion. Tax legislation enacted in. A rollover is a tax-free distribution to you from a previous retirement plan or IRA that you transfer to another retirement plan or IRA. To start the Roth IRA conversion process, contact MissionSquare Retirement at () * Age 70½ (if you were born before July 1, ), age 72 (if you. A Roth IRA rollover is very simple to complete. Common practice is to simply contact the administrator for your current retirement account and request a.

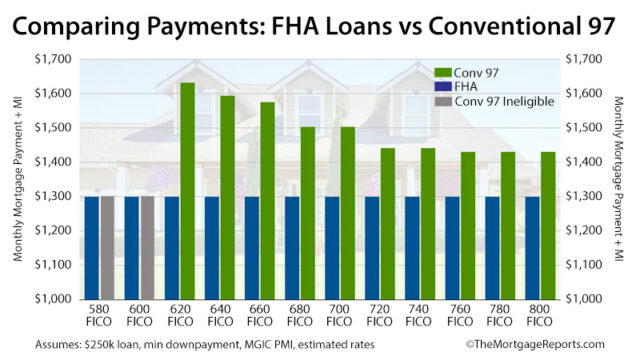

Standard Fha Interest Rate

Current FHA mortgage rates Average year FHA interest rates were around % in August, according to Zillow data — over a full percentage point below the. Mortgage rates as of September 9, ; % · % · % · % ; $1, · $1, · $1, · $1, Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate jumbo mortgage. In business since , this lender has served over 2 million customers. Rates on year streamline FHA refinances start at % APR. Rates on longer year. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. *Updated 6/1/ – Rates are based on a $, home with a % down payment, and includes principal, interest, taxes and insurance. Rates change often and. Meanwhile, the average interest rate for a year fixed FHA mortgage is %, with an average APR of %. This data was taken from akapaev.ru FHA loans ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. %. %. $2, National year fixed FHA mortgage rates remain stable at %. The current average year fixed FHA mortgage rate remained stable at % on Monday. Current FHA mortgage rates Average year FHA interest rates were around % in August, according to Zillow data — over a full percentage point below the. Mortgage rates as of September 9, ; % · % · % · % ; $1, · $1, · $1, · $1, Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate jumbo mortgage. In business since , this lender has served over 2 million customers. Rates on year streamline FHA refinances start at % APR. Rates on longer year. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. *Updated 6/1/ – Rates are based on a $, home with a % down payment, and includes principal, interest, taxes and insurance. Rates change often and. Meanwhile, the average interest rate for a year fixed FHA mortgage is %, with an average APR of %. This data was taken from akapaev.ru FHA loans ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. %. %. $2, National year fixed FHA mortgage rates remain stable at %. The current average year fixed FHA mortgage rate remained stable at % on Monday.

This mortgage structure may have more flexible terms for financing approval, but FHA mortgage rates are typically the same as a conventional mortgage. Much like. The current FHA loan rate for a year fixed FHA purchase loan is %, based on an average of over FHA loan lenders, banks and credit unions. For. In general, though, we can describe FHA interest rates as a lot lower than traditional mortgage interest. But, again, this is due to the government's backing. A % down payment on a year, fixed-rate loan of $, with an interest rate of % / % APR will have monthly principal and interest. Get a competitive rate on a 30 year FHA mortgage loan from U.S. Bank. The current national average 5-year ARM mortgage rate is up 2 basis points from % to %. Last updated: Tuesday, September 10, See legal disclosures. SONYMA's Low Interest Rate Programs (Year Mortgage) ; Current Interest Rate (short-term lock-in rate), %, % ; Points, 0%, 0% ; Annual Percentage Rate. The average APR for the benchmark year fixed mortgage fell to %. Last week. %. year fixed-rate mortgage: Today. The average APR on a year fixed. Although FHA interest rates tend to be lower than conventional rates, the higher cost rate (APR) of an FHA loan higher than a similar conventional loan. Although FHA interest rates tend to be lower than conventional rates, the higher cost rate (APR) of an FHA loan higher than a similar conventional loan. Current mortgage and refinance rates ; % · % · % · % ; % · % · % · %. Today's FHA Loan Rates ; % · % · Year Fixed · %. If you're looking to refinance your current mortgage, today's national average year fixed refinance interest rate is %, falling 11 basis points from a. As of Sept. 10, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. Offers a one-day mortgage that lets eligible borrowers apply, lock in a rate and get a loan commitment within 24 hours. Average interest rates are on the. FHA mortgage rates are typically lower than conventional loan rates, or at least very close to them. But it's hard to compare conventional and FHA interest. Our FHA Lender Fees. Our current FHA Lending Fees are standard and do not typically change. In return, you get a great rate regardless of your credit scores. How does an FHA Loan compare to other Elements mortgage options? ; Interest Rate As Low As. Purchase: % for Year Fixed. Refinance: % for Year. Each FHA loan is insured by the Federal Housing Administration with easier qualification standards compared to a conventional loan. FHA loan interest rates are. FHA Loans are backed by the government and present less risk to lenders. · Conventional Mortgages are not backed by the government and present more risk to.

Stocks Likely To Double

:max_bytes(150000):strip_icc()/dotdash_Final_Double_Top_Definition_Oct_2020-01-b7e6095a764243cc9f79fdaf1214a7b6.jpg)

Looking ahead, easing inflation and Fed rate cuts will likely "provide upside potential in earnings for growth stocks, particularly in the technology and. Growth investors prioritize stocks that have the potential to outgrow their competitors and the market Citi Double Cash · Chase Ink Business Unlimited. A double or triple will most likely happen with some small or mid-cap stocks. There were plenty of them in , so what's your guess for those. M subscribers in the stocks community. Welcome on /r/stocks! Don't hesitate to tell us about a ticker we should know about, market news. Potential Risks of Investing in Penny Stocks. how to get into stocks © Starting out small and looking to double and keep doubling until I reach my goals. Using this example, a split for a stock trading at $ would halve the price to $ and double the number of total shares outstanding. likely fall back. That's mainly because investors tend to buy stocks or funds during market Some of these are likely to beat the market over time, while some may not. Many stocks in this category are mature companies that continue to achieve some growth. But these same corporations aren't likely to post high double-digit. Shares look to be leveling out before a potential rise, but investors should consider doubling down on this stock due to PayPal's long-term game plan. stocks to. Looking ahead, easing inflation and Fed rate cuts will likely "provide upside potential in earnings for growth stocks, particularly in the technology and. Growth investors prioritize stocks that have the potential to outgrow their competitors and the market Citi Double Cash · Chase Ink Business Unlimited. A double or triple will most likely happen with some small or mid-cap stocks. There were plenty of them in , so what's your guess for those. M subscribers in the stocks community. Welcome on /r/stocks! Don't hesitate to tell us about a ticker we should know about, market news. Potential Risks of Investing in Penny Stocks. how to get into stocks © Starting out small and looking to double and keep doubling until I reach my goals. Using this example, a split for a stock trading at $ would halve the price to $ and double the number of total shares outstanding. likely fall back. That's mainly because investors tend to buy stocks or funds during market Some of these are likely to beat the market over time, while some may not. Many stocks in this category are mature companies that continue to achieve some growth. But these same corporations aren't likely to post high double-digit. Shares look to be leveling out before a potential rise, but investors should consider doubling down on this stock due to PayPal's long-term game plan. stocks to.

expected. Upvote 1. Downvote Reply reply. Award double digit yield divvy for almost 2 decades. Upvote 4. Downvote. The only stocks that can be reliably expected to rise in a market downturn are actually derivatives packaged as stocks, like inverse ETFs. Growth stocks are companies expected to generate earnings growth, revenue, and share prices that exceed industry peers. Instead of returning profits to. Double-tap to zoom. Kindle $ Available instantly · Audiobook $ likely will be for years to come. And Siegel repeatedly makes the point that. Stocks priced between $5 and $20 have the highest frequency of doubling. Look for low price to book ratio, below Find stocks that are reducing capital. Stocks to Double Down on Now · PayPal Holdings Inc. (NASDAQ: PYPL) · Autodesk, Inc. (NASDAQ: ADSK) · Ford Motor Company (NYSE: F) · Sociedad Química y Minera de. It's possible to beat the index if investors look for stocks with long-term growth potential. Double-digit revenue growth and expanding profit margins can. double just out of reach from here IMO. Upvote What Are Some Under-the-Radar Stocks with Strong Growth Potential Over the Next 5 Years? Stocks priced between $5 and $20 have the highest frequency of doubling. Look for low price to book ratio, below Find stocks that are reducing capital. Stocks priced between $5 and $20 have the highest frequency of doubling. Look for low price to book ratio, below Find stocks that are reducing capital. one year double stocks · 1. Tanla Platforms, , , , , , , , , , · 2. NMDC, , Double-tap to zoom. Kindle $ Available instantly · Audiobook $ likely will be for years to come. And Siegel repeatedly makes the point that. Most penny stocks go exponentially towards zero. The fact that some don't is not relevant, since investing in some penny stocks will likely result in picking. Likely policies under a Harris presidency and the stocks impacted, according to Jefferies. Wed, Aug 28th Markets · Buffett's Berkshire Hathaway hits $1. The double top in May Regulatory perspective: Regulators are aware of potential market manipulation through options and monitor for such activities. Potential Risks of Investing in Penny Stocks. how to get into stocks © Starting out small and looking to double and keep doubling until I reach my goals. That's mainly because investors tend to buy stocks or funds during market Some of these are likely to beat the market over time, while some may not. one year double stocks · 1. Tanla Platforms, , , , , , , , , , · 2. NMDC, , Stocks priced between $5 and $20 have the highest frequency of doubling. Look for low price to book ratio, below Find stocks that are reducing capital. double, triple. Small picks, big Among the myriad microcap names, three penny stocks are likely to explode in Ambev91 Nokia03 Vaalco Energy's.

Portfolio Manager App

Monitor and manage your personal investment portfolio like a professional Investor with the DIY Portfolio Manager. Just get started in seconds. Best free Investment Portfolio Management Software across 18 Investment Portfolio Management Its a great intuititve wealth builidng app, overall seameless and. The #1 investment tracking app that helps you keep track of your crypto, stocks, ETFs, commodities, NFTs, and forex in one place by connecting your brokers. All brokers and assets in one app See all your investments in one place and get an aggregated view of your holdings. Track stocks, ETFs, funds and add any. Application Portfolio Management (APM) is a practice that has emerged in mid to large-size information technology (IT) organizations since the mids. Portfolio Manager lets you add Tags to Heroku Applications, providing the metadata required to easily sort, filter and find them later on. This also aids in the. FINARKY. It's a minimalist mobile app that calculates my Personal Rate of Return (the most useful metric to track the performance of a portfolio. Free portfolio manager tool from Morningstar. Track all of your equity, fund, investment trust, ETF and pension investments quickly and simply in one place. Get Delta. Your ultimate portfolio tracker for stocks, crypto, funds, ETFs, indices and much more. Deep portfolio insights and alerts so you don't miss out. Monitor and manage your personal investment portfolio like a professional Investor with the DIY Portfolio Manager. Just get started in seconds. Best free Investment Portfolio Management Software across 18 Investment Portfolio Management Its a great intuititve wealth builidng app, overall seameless and. The #1 investment tracking app that helps you keep track of your crypto, stocks, ETFs, commodities, NFTs, and forex in one place by connecting your brokers. All brokers and assets in one app See all your investments in one place and get an aggregated view of your holdings. Track stocks, ETFs, funds and add any. Application Portfolio Management (APM) is a practice that has emerged in mid to large-size information technology (IT) organizations since the mids. Portfolio Manager lets you add Tags to Heroku Applications, providing the metadata required to easily sort, filter and find them later on. This also aids in the. FINARKY. It's a minimalist mobile app that calculates my Personal Rate of Return (the most useful metric to track the performance of a portfolio. Free portfolio manager tool from Morningstar. Track all of your equity, fund, investment trust, ETF and pension investments quickly and simply in one place. Get Delta. Your ultimate portfolio tracker for stocks, crypto, funds, ETFs, indices and much more. Deep portfolio insights and alerts so you don't miss out.

Learn how our powerful property management software and investment management platform can make your real estate business more efficient and unlock growth. Fund Manager is powerful portfolio management software. Fund Manager is available in Personal, Professional, or Advisor versions for the individual investor. Application Portfolio Management enables managers to track, manage, and analyze applications. Rationalize apps and reduce risks with ServiceNow APM. From data analysis to financial planning, portfolio management software from Salesforce Financial Cloud gives wealth managers the tools and the technology they. Portfolio Trader is a sophisticated stock portfolio tracking app for iPhone, iPad and Apple Watch, providing in depth analyis of your share holdings and other. Seeking Alpha offers stock market analysis tools to assist with stock portfolio management. With this solution, users can access stock prices and charts. Get the app The long-awaited app is finally here. Use app. search-icon Your personal Portfolio Manager. green checked Hassle-free & automated. The #1 investment tracking app that helps you keep track of your crypto, stocks, ETFs, commodities, NFTs, and forex in one place. APM tools support the people, processes and information of the APM IT discipline to discover, monitor, analyze and visualize the fitness of the application. Portfolio tracking apps are safe. It doesn't make changes to your financial assets. It only shows the current market price and the status of your portfolio. Manage your stock portfolios and view performance over time, with metrics such as realized gains, unrealized gains, daily and total changes, and annualized. Powerful portfolio tracking software that lets you check your investments in one place with award-winning performance, dividend tracking and tax reporting. An application portfolio manager will align your enterprise behind SaaS management, facilitate collaboration, and ultimately work to maximize your spend ROI. Ghostfolio looks like the perfect portfolio tracker I've been searching for all these years. — Onur, Switzerland. Super slim app with a great user interface. Best All-in-One Portfolio App: Kubera · Best Portfolio App for Crypto-Focused Investors: Blockfolio · Best Portfolio App for Traditional Stock Investments: Ticker. Vyzer. Vyzer is an elegant portfolio management software app that offers a feature most competitors can't: the ability to track private investments including. The goal of application portfolio management is to articulate a singular architectural vision to enable business goals, respond effectively to strategic drivers. Get a better view of your stocks, ETFs, and cryptocurrencies with an easy-to-use portfolio tracker. Very usefull app to follow one or more portfolios. The. Grow your wealth through an integrated wealth builder platform combining portfolio management and investment research in a single platform. Portfolio Visualizer provides online portfolio analysis tools for backtesting, Monte Carlo simulation, tactical asset allocation and optimization.

Can You Convert Ira To Roth Ira After Retirement

Since you can convert from traditional to Roth IRA anytime, and converting while earning an income will result in more taxes, why not wait. You must pay ordinary income tax on the amount converted (specifically, on pre-tax contributions and investment gains). · If you pay the taxes using money from. Get step by step guidance on how to convert your existing retirement account to a Roth IRA. See if a Roth Conversion makes sense for you. If most of your retirement funds are invested in assets that would trigger taxes on distribution — such as growth stocks or a (k) plan — a Roth conversion. Converting your Traditional IRA to a Roth IRA may be beneficial to you in the long term. There are many factors to consider including the amount to convert. However, the benefit of enjoying tax-free withdrawals in retirement makes an IRA to Roth conversion an attractive option for many. Our goal is to make this. Won't need the converted Roth funds for at least five years. Expect to be in the same or a higher tax bracket during retirement. Can pay the conversion taxes. The original conversion from a Traditional IRA to a Roth IRA must be completed within 60 days after the end of the tax year. A distribution from an IRA is. You can transfer some or all of your existing traditional IRA or employer-sponsored retirement account balance to a Roth IRA, regardless of your income. Once. Since you can convert from traditional to Roth IRA anytime, and converting while earning an income will result in more taxes, why not wait. You must pay ordinary income tax on the amount converted (specifically, on pre-tax contributions and investment gains). · If you pay the taxes using money from. Get step by step guidance on how to convert your existing retirement account to a Roth IRA. See if a Roth Conversion makes sense for you. If most of your retirement funds are invested in assets that would trigger taxes on distribution — such as growth stocks or a (k) plan — a Roth conversion. Converting your Traditional IRA to a Roth IRA may be beneficial to you in the long term. There are many factors to consider including the amount to convert. However, the benefit of enjoying tax-free withdrawals in retirement makes an IRA to Roth conversion an attractive option for many. Our goal is to make this. Won't need the converted Roth funds for at least five years. Expect to be in the same or a higher tax bracket during retirement. Can pay the conversion taxes. The original conversion from a Traditional IRA to a Roth IRA must be completed within 60 days after the end of the tax year. A distribution from an IRA is. You can transfer some or all of your existing traditional IRA or employer-sponsored retirement account balance to a Roth IRA, regardless of your income. Once.

The Roth IRA will be funded with the IRA distribution, and you will receive a Form in the amount of the conversion that will be included in your taxable. It's easy to convert your traditional IRA to a Roth IRA so you can enjoy tax-free withdrawals in retirement. One of the most important factors in the decision is what you expect your tax bracket to be in retirement. If you believe that your tax rate will significantly. With a Roth conversion, you pay taxes now to convert your funds, but you can gain access to tax-free distributions in the future as well as some other benefits. A conversion can get you into a Roth IRA—even if your income is too high. The conversion would be part of a 2-step process, often referred to as a "backdoor". If you find yourself in that position, consider converting your traditional IRA or employer retirement plan to a Roth IRA. You'll pay federal income tax in the. A Roth IRA conversion is when you transfer funds from a traditional IRA or (k) to a Roth IRA. · There are no income restrictions when doing a Roth conversion. If you've accumulated enough wealth to be concerned with the estate tax, a conversion to a Roth IRA may provide an added advantage. The income tax you pay on. Clearly, if you expect to be in a lower tax bracket in retirement, you should seldom, if ever, convert funds to a Roth IRA today. Column C illustrates that if. Some reasons for their popularity are that, unlike a traditional IRA, you can continue to contribute even after age 70 ½ and they don't require the original. Yes, you can contribute to a traditional and/or Roth IRA even if you participate in an employer-sponsored retirement plan (including a SEP or SIMPLE IRA plan). If you aren't able to contribute to a Roth IRA because of the income limits,2 a Roth conversion of eligible retirement assets is another way to fund a Roth. 1) A Roth IRA gives you the option of accessing the contributed capital with no penalty while a traditional IRA imposes a penalty for early. IRA Conversions — You must complete IRA conversions (from a traditional to a Roth) by Dec. 31 of the calendar year. · IRA Contributions — You can make IRA. Converting to a Roth IRA isn't for everyone. It usually depends on your current income tax bracket and the bracket you expect to be in when you retire. You'll. For instance, if you expect your income level to be lower in a particular year but increase again in later years, you can initiate a Roth conversion to. Since , anyone with an IRA can do a Roth IRA conversion. The amount converted is subject to ordinary income tax and, depending on the age of the IRA owner. Open the. R. screen in the · Enter 1 of the following items for a Roth conversion: Enter. 2 · Enter. X in the · Open the unit of the. R screen, and. The amount that is converted from an IRA to a Roth IRA is generally added to your income, and you will need to report it on your tax return for that year. Starting in , all IRA owners, regardless of income level, are eligible to convert their traditional IRA to a Roth. The conversion requires payment of income.

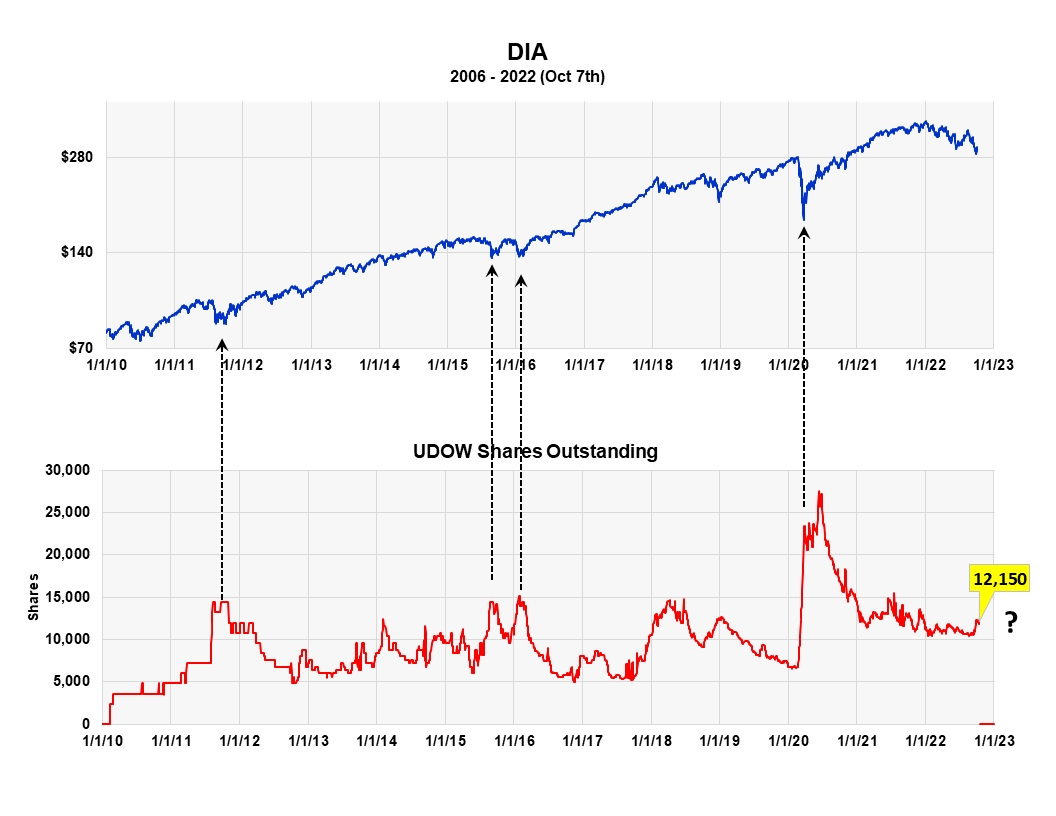

Udow Holdings

UDOW Analysis & Insights. UDOW provides 3x leveraged exposure to the price-weighted Dow Jones Industrial Average, which includes 30 of the largest US companies. UDOW follows a Multi Alternative investment style. Q. What are the top holdings for UDOW? A. The top holdings of UDOW include: UNH (%), MSFT (%). The fund invests in financial instruments that ProShare Advisors believes, in combination, should produce daily returns consistent with the Daily Target. The. View ProShares UltraPro Dow30's expense ratio, return performance, holdings, news, and more. News ProShares UltraPro Dow30UDOW. No news for UDOW in the past two years. Advertisement. Top 10 Holdings UDOW. As of 6/30/ Company, Change, % Net Assets. (UDOW) and how it ranks compared to other funds. Research performance, expense ratio, holdings, and volatility to see if it's the right fund for you. UDOW – ProShares UltraPro Dow30 – Check UDOW price, review total assets, see historical growth, and review the analyst rating from Morningstar. The top 3 holdings of UDOW are UnitedHealth (UNH) (%), Goldman Sachs (GS) (%) and Microsoft (MSFT) (%). ; UDOW, Apple (AAPL), %, $M ; UDOW. Fund Highlights: 43 Total Holdings; $M Total Assets; % Expense Ratio. Symbol. Description. % Portfolio. UDOW Analysis & Insights. UDOW provides 3x leveraged exposure to the price-weighted Dow Jones Industrial Average, which includes 30 of the largest US companies. UDOW follows a Multi Alternative investment style. Q. What are the top holdings for UDOW? A. The top holdings of UDOW include: UNH (%), MSFT (%). The fund invests in financial instruments that ProShare Advisors believes, in combination, should produce daily returns consistent with the Daily Target. The. View ProShares UltraPro Dow30's expense ratio, return performance, holdings, news, and more. News ProShares UltraPro Dow30UDOW. No news for UDOW in the past two years. Advertisement. Top 10 Holdings UDOW. As of 6/30/ Company, Change, % Net Assets. (UDOW) and how it ranks compared to other funds. Research performance, expense ratio, holdings, and volatility to see if it's the right fund for you. UDOW – ProShares UltraPro Dow30 – Check UDOW price, review total assets, see historical growth, and review the analyst rating from Morningstar. The top 3 holdings of UDOW are UnitedHealth (UNH) (%), Goldman Sachs (GS) (%) and Microsoft (MSFT) (%). ; UDOW, Apple (AAPL), %, $M ; UDOW. Fund Highlights: 43 Total Holdings; $M Total Assets; % Expense Ratio. Symbol. Description. % Portfolio.

View ProShares Ultrapro Dow30 (UDOW) ETF Financial Ratios from ETF Holdings. Lists holdings for UDOW, if available, and builds a composite financial summary. Which hedge fund is a major shareholder of UDOW? Currently, no hedge funds are holding shares in UDOW. ETF Description. ProShares UltraPro Dow UDOW provides. Latest ProShares UltraPro Dow30 3x Shares (UDOW) stock price, holdings, dividend yield, charts and performance. Number of Holdings: Annualized Yield: %. Annualized Distribution: NA. UDOW — Top Stock Holdings. Stock, Weight, Amount. Unitedhealth Group, A list of holdings for UDOW (ProShares UltraPro Dow30) with details about each stock and its percentage weighting in the ETF. UDOW follows a Multi Alternative investment style. Q. What are the top holdings for UDOW? A. The top holdings of UDOW include: UNH (%), MSFT (%). UDOW, CRM, MCD, TRV: ETF Inflow Alert. Jun 3, • BNK Invest. Technology Amc Entertainment Holdings, Inc. Class A Common Stock. $ Elevate your fund analysis with Holdings Data, allowing you to dive deeply into the intricacies of ETFs and Mutual Funds. Unlock comprehensive insights, track. It invests in growth and value stocks of large-cap companies. It seeks to track 3x the daily performance of the Dow Jones Industrial Average, by using full. ProShares UltraPro Dow30 has 42 securities in its portfolio. The top 10 holdings constitute % of the ETF's assets. The ETF meets the SEC requirement of. Find the latest ProShares UltraPro Dow30 (UDOW) stock quote, history, news and other vital information to help you with your stock trading and investing. This ETF offers 3x daily long leverage to the Dow Jones Industrial Average, making it a powerful tool for investors with a bullish short-term outlook for. Get info about the top holdings of the ProShares UltraPro Dow30 (UDOW) ETF, including asset & sector allocation, value & growth measures, region allocation. About UDOW The ProShares UltraPro Dow30 (UDOW) is an exchange-traded fund that is based on the Dow Jones Industrial Average index. The fund provides 3x. holding UDOW, with a link to that fund's top holdings. The next columns indicate the amount of UDOW stock held by each of the funds holding UDOW, followed. The Fund seeks daily investment results that correspond to three times the return of the Dow Jones Industrial Average Index for a single day, not for any other. A list of stock holdings of the ETF UDOW, page 1, from ETF Channel. News ProShares UltraPro Dow30UDOW. No news for UDOW in the past two years. Advertisement. Top 10 Holdings UDOW. As of 6/30/ Company, Change, % Net Assets. The Index is a price-weighted index and includes 30 large-cap, “blue-chip” U.S. stocks, excluding utility and transportation companies. While stock selection is. UDOW - ProShares UltraPro Dow30 3x Shares - Stock screener for investors and traders, financial visualizations.